capital gains tax proposal effective date

1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April. The effective dates of the newly enacted provisions generally are expected to be Jan.

Under a proposed transition rule federal long-term capital gains recognized later in.

. Get Tax Lein Info You Can Trust. Urban Catalyst is a leader in QOZ investing. But the effective date.

The Green Book indicated the capital gain hike would be effective for gains required to be recognized after the date of announcement xxvi. Limit the maximum 199A qualified business income deduction to 500000 in the case of a joint return 400000 for an individual return 250000 for a married individual filing. Talk to Certified Business Tax Experts Online.

In 2022 it would kick in for single filers with taxable income over 400000 and for married couples at 450000. The proposed effective date for the 25 long-term capital gain rate is September 13 2021. The effective date for most of the proposals is Jan.

The estate and gift proposal would be effective for gains on property transferred by gift and on property owned at death by decedents dying after December 31 2021. Ad The Leading Online Publisher of National and State-specific Legal Documents. May 14 2021 Listen Now 2623 Download Subscribe John P.

Ad Ask Independently Verified Business Tax CPAs Online. No effective date for the change in capital gain tax rates for individuals was mentioned on the campaign trail or in President Bidens American Families Plan speech or fact sheet but the. Taxpayers can consider triggering gain before the potential effective date of a capital gains change but should assess the outlook carefully and understand the risk.

June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains. The new rate would apply to gains realized after Sep. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28.

Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a.

247 Access to Reliable Income Tax Info. Gimigliano Principal Washington National Tax KPMG US 1 202-533-4022 Podcast overview President Biden has proposed a. The proposal would increase the effective tax rate on global intangible low-taxed income GILTI from the current 105 to a 165625 rate.

Urban Catalyst is a leader in QOZ investing. Iii From a top individual rate of 882 to rates ranging from 965 to 109. Get your tax refund fast.

The effective date for most of the proposals is Jan. 1 2022 but certain provisions may have proposed effective dates tied to the date of. The House bill would apply the increase to gain recognized after September 13 2021.

April 27 2021 Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. Get Access to the Largest Online Library of Legal Forms for Any State. Ad File your 2021 taxes even if you missed the deadline.

The proposal would lower the. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. President Bidens tax proposal first introduced in the American Families Plan includes increasing the top tax rate on capital gains to 434 from 238 for households with.

The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced.

World Tax And World Tp 2022 Is Live A Guide To The World S Leading Tax Firms International Tax Review

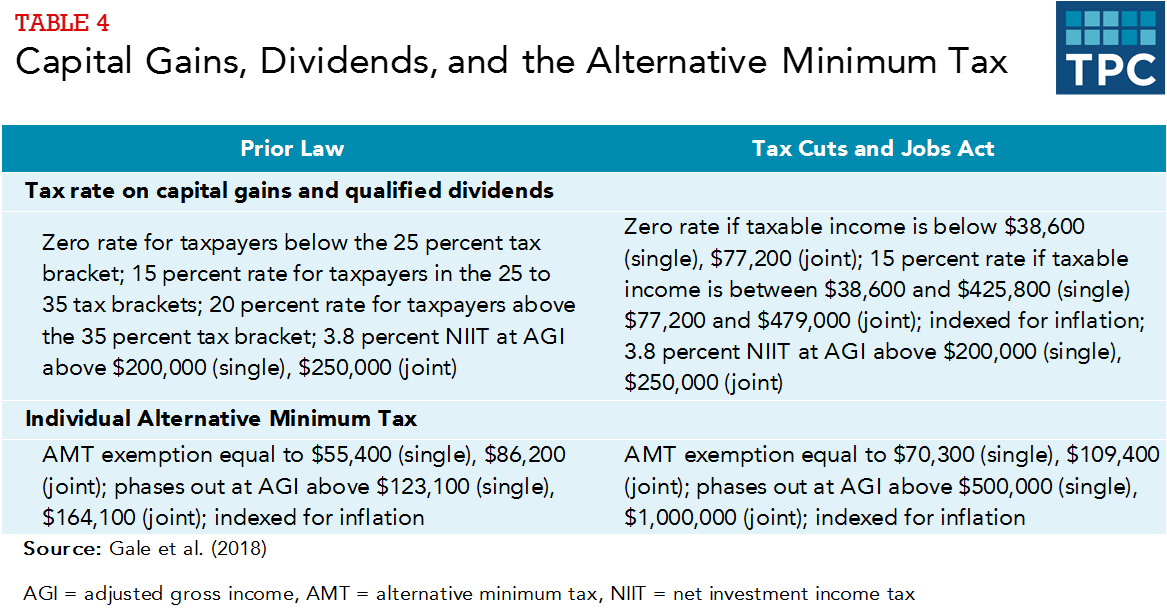

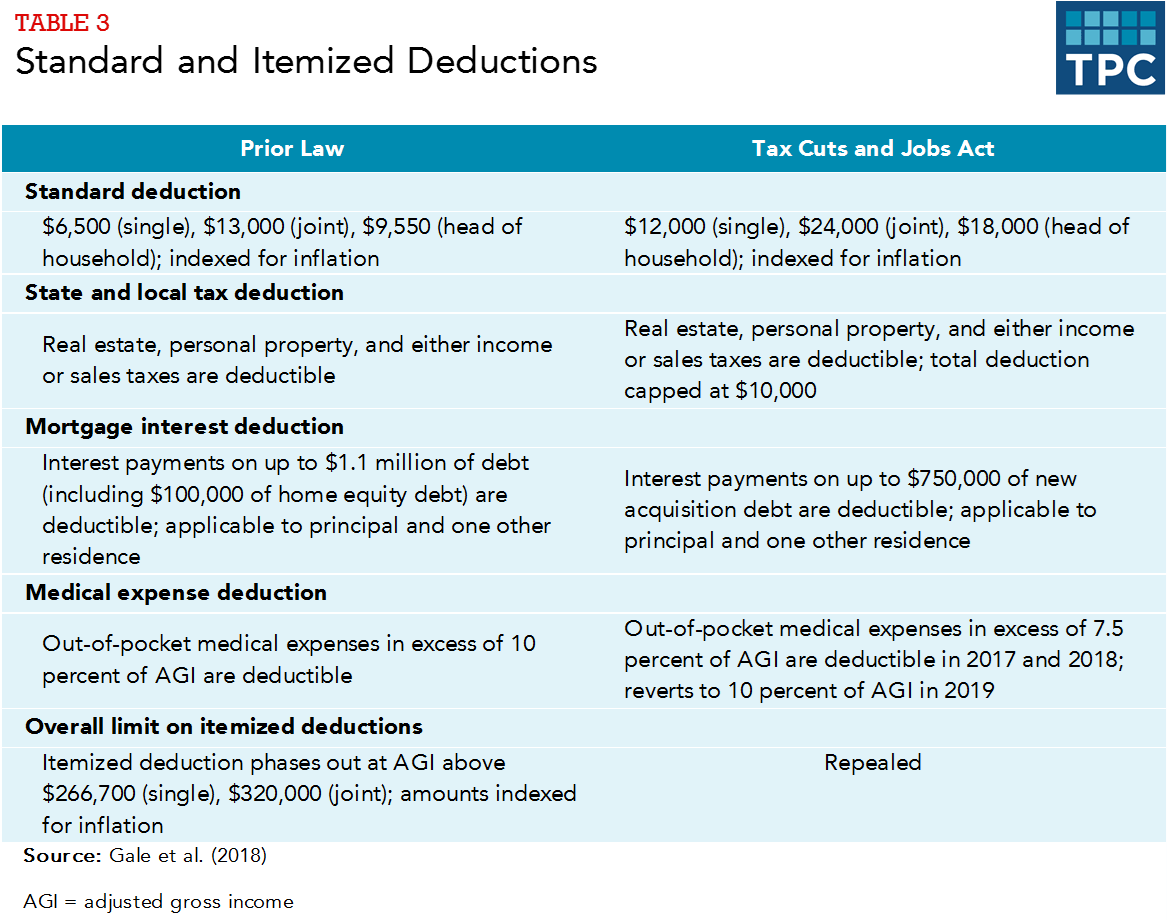

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Takeovers In Australia A Guide Ashurst

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

International Tax Debate Moves From Digital Focus To Global Minimum

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Finance Bill 2022 Highlights Of Direct Taxes Gst Proposals

Untangling Tax Reform Business Losses And Nols For Corporate And Noncorporate Taxpayers Baker Tilly